If there was a ever a good reason to use Amazon instead of Barnes and Nobles or your local bookstore, it was the sales tax. Californians pay 7.25 percent, unless they order online from a company headquartered out of state. In these depressed times, it ended up being much more beneficial to order things from Amazon, instead of buying local. Of course, local businesses were taking a hit, but cheaper is cheaper after all.

Enter Gov. Jerry Brown with a plan to raise some revenue. He signed a new law that would force Amazon to start collecting sales tax on items purchased in the state. The reasoning he gave was that a retailer may not be based in California, but it does have affiliates here.

Amazon responded immediately: “This legislation is counterproductive and will not cause our retail business to collect sales tax for the state,” wrote Amazon’s Vice President of Global Public Policy in a letter to the state government. The state now expects Amazon to sue to get the law overturned. Until then, Amazon simply cuts its ties with all of its local affiliates, which number 25,000 people who earned at least some of their salary supplying goods via Amazon.

Amazon is not the only company to choose to ignore the new law. Overstock.com is headquartered in Utah, so it argues that it is also exempt from paying California sales tax.

Betty Yee is the member of the Board of Equalization charged with enforcing the new law. She says that the decisions by Amazon and Overstock came as no surprise, but they won’t stop the state from claiming its tax revenues. “We’ll bill them at the end of this quarter, based on estimates either they provide or that we come up with from other data sources,” she said. After that, the state will have to wait and see whether Amazon agrees to pay or not.

But Yee insists that the state will not just give up the money if Amazon refuses to pay. “We’ll consider other courses of action,” she warns. She does have plenty of local support, including the California Retailers Association. After all, its members are losing business to Amazon, which can undercut them by knocking out the sales tax.

On the other hand, both Amazon and Overstock are major internet businesses, and they have the support of at least one more large company, eBay, which is headquartered locally.

Jeff Bezos of Amazon has said that the only way to fix this standoff is through federal legislation. Some suggest, however, that he is being disingenuous. When Senator Dick Durbin (D-IL) proposed such federal legislation in the Main Street Fairness Act, Amazon responded by pulling its affiliates out of his state.

Durbin even has bipartisan support in the person of Republican Senator Mike Enzi of Wyoming. While this may seem to violate the Republican mantra of no new taxes, “Sales taxes (on Internet purchases) are not new taxes,” at least according to Scott Peterson of the Streamlined Sales Tax Governing Board, Inc.

According to Forrester Research, an independent technology and market research company, online sales across the U.S. could be worth as much as $279 billion by 2015, the result of a 10 percent annual growth rate. Though sales tax rates vary from state to state, that still means states are losing out on billions of dollars in potential revenue simply because the law has failed to keep up with rapidly advancing internet technologies.

What happens with Amazon in California could signal whether the states are finally catching up.

Read More at NBC Bay Area.

Read More at the SF Gate.

Read More at MSNBC.

Read More at Tech Crunch.

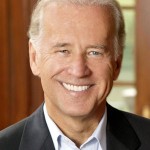

Vice President Biden Joins Twitter

Vice President Biden Joins Twitter  Neutral Zone

Neutral Zone